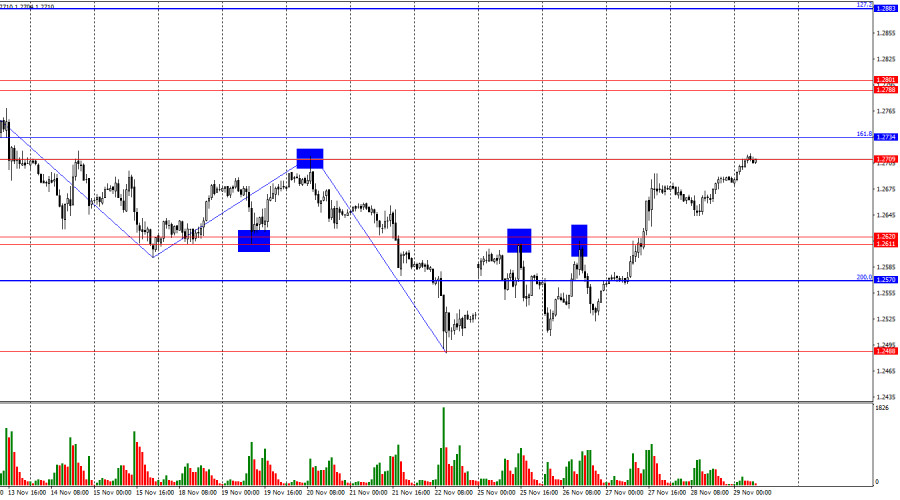

On the hourly chart, GBP/USD rose on Thursday to the resistance zone of 1.2709 – 1.2734, which includes the peak of the most recent wave. A close above this zone would signal not only the continuation of the pound's upward movement but also the potential end of the bearish trend. However, a rebound from this zone could indicate a reversal in favor of the dollar and the continuation of the bearish trend.

The wave structure is straightforward. The most recent completed downward wave broke below the low of the previous wave, while the current upward wave has yet to break the previous peak. This suggests that the bearish trend is still in formation. For the bearish trend to show signs of ending, the pair must return to the 1.2710 level and close above the last peak.

On Thursday, no significant challenges were evident for the U.S. dollar, yet bullish traders continued to push the pound higher despite the absence of supporting fundamentals. In my view, it is still premature to conclude a trend reversal. However, it should be noted that the bulls are very close to achieving this milestone.

Yesterday, there was no news from either the UK or the U.S., but traders consistently showed demand for the pound throughout the day. If they manage to close above the 1.2709 – 1.2734 zone today, even in the absence of major economic news, the likelihood of further pound growth will increase significantly. However, I currently lean toward a scenario in which the pair rebounds and returns to the 1.2488 level.

Although the pound has seen moderate growth over the past week, there were few substantial drivers to justify this movement. U.S. economic data was mixed—neither strong nor weak. However, next week promises a range of critical U.S. reports, including labor market data, which will provide more clarity for both bulls and bears.

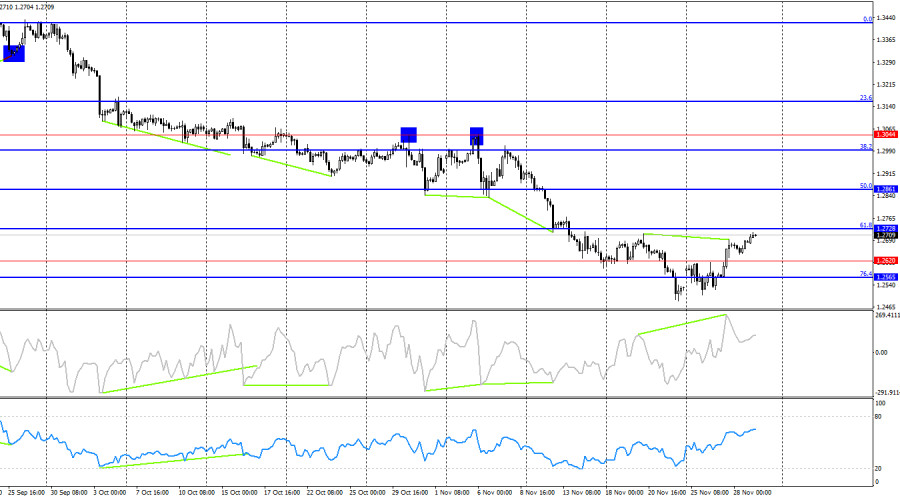

On the 4-hour chart, the pair consolidated above the 1.2620 level. However, a bearish divergence formed with the CCI indicator. This divergence has not materialized as anticipated, which could hint at a possible trend change in the market. Nevertheless, a rebound from the 1.2728 level could spark a fresh decline in the pair. On the hourly chart, prices may also reverse from this key resistance zone. Thus, a decline in the pound cannot yet be ruled out.

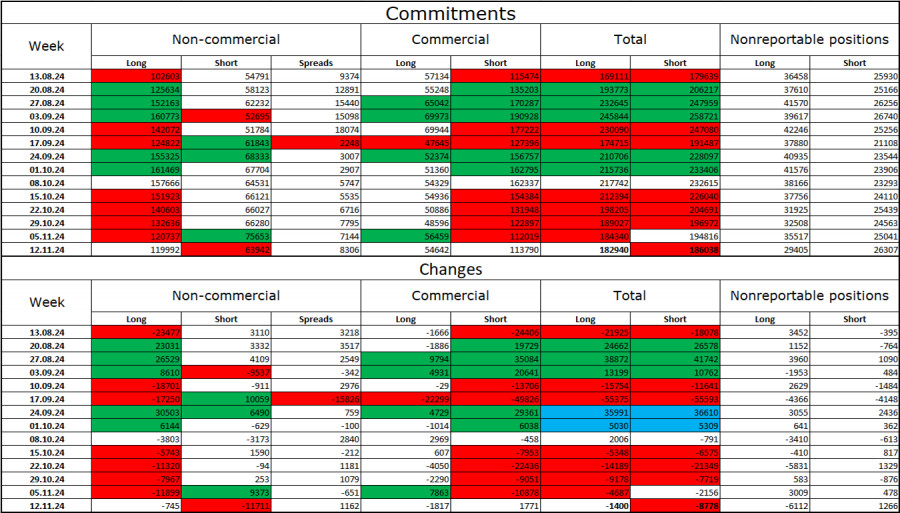

Commitments of Traders (COT) Report

The sentiment among Non-commercial traders became more bullish during the most recent reporting week. The number of long positions held by speculators decreased by 745 contracts, while short positions dropped significantly by 11,711 contracts. Bulls maintain a clear lead, with the gap between long and short positions at 56,000: 120,000 longs versus 64,000 shorts.

In my opinion, the pound still faces downward risks, and even the COT data supports the strengthening of bearish positions. Over the past three months, the number of long contracts has risen from 102,000 to 120,000, while short contracts have increased from 55,000 to 64,000. I believe that professional traders will likely continue reducing their long positions or increasing short positions as the factors supporting pound purchases have already been largely exhausted. Graphical analysis also supports a potential decline in the pound.

Economic Calendar for the U.S. and UK

Friday's economic calendar is devoid of significant events. As such, the fundamental backdrop is unlikely to influence trader sentiment today.

GBP/USD Forecast and Trading Advice

New sales of the pair are possible after a rebound from the 1.2709 – 1.2734 zone on the hourly chart, with targets at 1.2611 – 1.2620 and potentially lower. Purchases can be considered if the pair closes above the 1.2611 – 1.2620 zone on the hourly chart, targeting 1.2709. This target was already reached overnight.

Fibonacci levels have been plotted at 1.3000 – 1.3432 on the hourly chart and at 1.2299 – 1.3432 on the 4-hour chart.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment