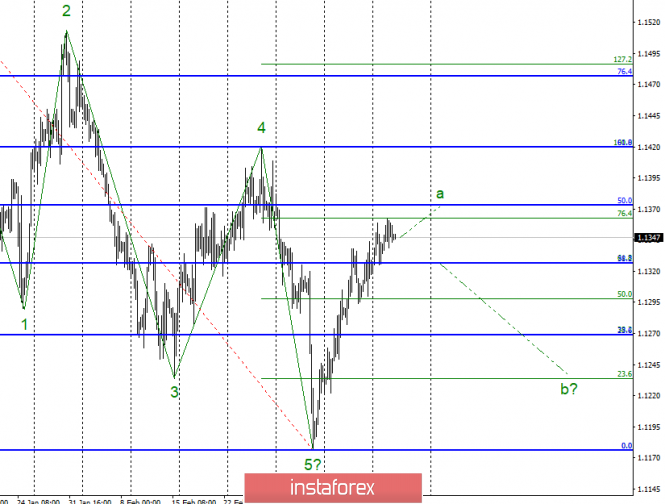

Wave counting analysis:

On Tuesday, March 19, trading ended on EUR / USD by 15 bp increase for the pair EUR / USD. Thus, even at a very slow pace, wave a continues its construction with targets located near the 50.0% level on the older Fibonacci grid. A very important event for the couple will take place tonight - the Fed's press conference following a two-day meeting. Markets do not expect any changes in monetary policy, but they expect important statements from Jerome Powell. Thus, Powell's strong statements can lead to the beginning of the construction of a correctional wave b, and the weak ones - to the lengthening of wave a.

Sales targets:

1.1269 - 38.2% Fibonacci (small grid)

1,1234 - 23.6% Fibonacci (small grid)

Purchase goals:

1.1373 - 50.0% Fibonacci

General conclusions and trading recommendations:

The pair presumably continues to build the first wave of the upward trend. Now I recommend buying a pair with targets located near the mark of 1.1373, which corresponds to 50.0% Fibonacci, but take into account that the construction of a correctional wave b may soon begin. Special care will be needed tonight, as important news from the Fed can lead to sharp reversals on the instrument.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment