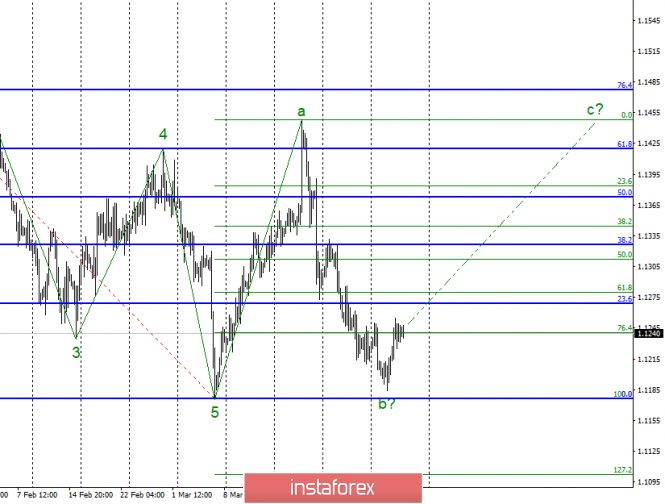

Wave counting analysis:

On Wednesday, April 3, trading ended for EUR / USD by 30 bp and the minimum of the expected wave 5 remains unchanged, which still retains the chances of building an upward wave with exactly the upward trend. If the current wave counting is correct, then from current positions, the tool will continue to rise with targets located around 1.1450. Eurocurrency is of great importance now that it has been included in the news background. Yesterday, support was received from reports on retail sales in the EU and a weak ISM index in the US. However, it is not yet considered a fact for the pair to continue receiving this support in the coming weeks. Thus, the instrument can still make a successful attempt to break the wave minimum 5.

Sales targets:

1.1177 - 100.0% Fibonacci

Purchase goals:

1.1448 - 0.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly has completed the construction of wave b. Now, I recommend buying a pair with targets near the 1.1455 mark, which corresponds to the maximum of wave a, based on the construction of wave c. Purchases should not be large in volume, as the news background may not support the euro in the coming days, which will force the markets to switch to new sales.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment