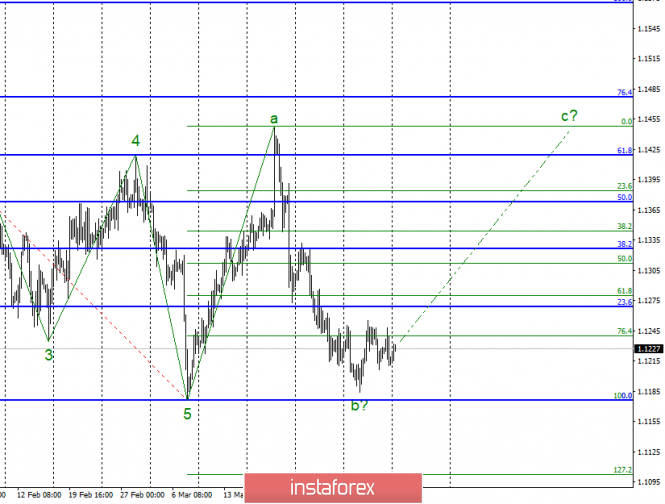

Wave counting analysis:

On Friday, April 5, trading ended for EUR / USD with a decrease of several basis points. In fact, the wave pattern does not change at all in the last few days. Wave b is supposedly completed, and I still expect to build an upward wave with targets around 1.1450 and higher. Similar to what happened before, the news background plays against the euro which won't give the market any reason to buy an instrument. Today, it is unlikely that something will change dramatically, since there will be no important news based on the calendar. Thus, the construction of the ascending wave remains the main option until the successful attempt to break through the minimum of the supposed wave 5.

Sales targets:

1.1177 - 100.0% Fibonacci

Purchase goals:

1.1448 - 0.0% Fibonacci

General conclusions and trading recommendations:

The pair supposedly has completed the construction of wave b. Now, I recommend buying a pair with targets near the 1.1455 mark, which corresponds to the maximum of wave a, based on the construction of wave c. Purchases should not be large in volume, since the news background does not support the euro. This, in turn, can lead to the resumption of sales by the market, as well as the complication of the downward trend.

The material has been provided by InstaForex Company - www.instaforex.com

Download NOW!

Download NOW!

No comments:

Post a Comment