The U.S. currency is finally starting to see some demand. The greenback surged after the inflation report for March showed that the Consumer Price Index rose 3.5% over the last 12 months. The market did not expect such a sharp increase in inflation and responded by buying the dollar. In fact, I already expected the dollar to strengthen last week, but then the market simply ignored all the positive reports from the U.S.. However, it couldn't go on like this all the time. Both instruments have finally declined. EUR/USD confirmed the intention to continue building wave 3 or C, as recently there was a threat of complicating the entire wave pattern. And this was fraught with changes in forecasts, which is always unpleasant.

However, the market is now convinced that the Federal Reserve will start easing monetary policy "when the time comes." Over the past months, FOMC members have repeatedly mentioned that the central bank will begin to lower rates when it is confident that inflation is quickly moving towards the 2% target. If inflation cannot fall below 3%, and has been rising in recent months, has it grown confident? In my opinion, no.

The CME's FedWatch Tool showed expectations of a June cut has decreased from 56% to 19%. Now the market no longer believes that the first rate cut will take place in June. And it's absolutely right. I have repeatedly mentioned that one should not expect a rate cut in March, nor in June. Policy easing should be expected when the CPI falls to at least 2.5%. In the near future, this is not expected, so the Fed may keep the rate at its peak for a long time. Maintaining the Fed's hawkish policy should support the U.S. dollar. Even without the factor of accelerated inflation, I believed that the euro was not depreciating fast enough, and now I am confident that its ticket to the 6-figure mark is booked. Moreover, it shouldn't stop falling around the 6-figure mark. Wave 3 or C should take on a five-wave form, and currently only the third wave is being built. Therefore, my readers can continue to look for sell signals. Today, such a signal was the rebound from the Fibonacci level of 61.8%.

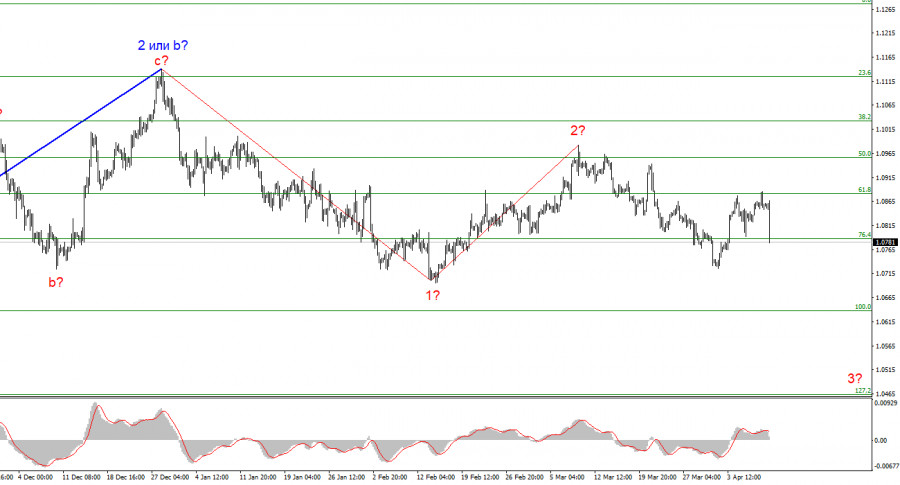

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% Fibonacci, as the news background remains in favor of the dollar. New sell signals are needed.

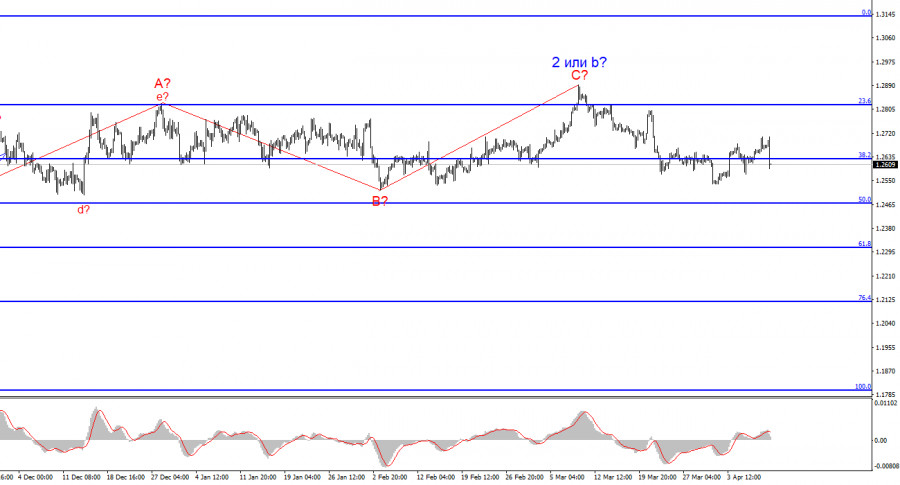

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless we can guarantee that wave 2 or b has ended, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The quotes haven't moved far away from the peaks, so we cannot confirm the start of the wave 3 or c.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment