After a wild party, a hangover inevitably follows. The start of such a party for EUR/USD was the release of the July US labor market data. Disappointing data sharply boosted the chances of a federal funds rate cut by 125 basis points in 2024. From the European Central Bank, derivatives expect around 80 bps. No wonder the euro soared to a seven-month high at jet speed. However, the hangover took only a short time to arrive.

Strong economy - strong currency. The dollar must be sold if the US is already in a recession. Investors decided this and demanded a lifebuoy through aggressive monetary easing from the Federal Reserve. However, opinions vary as much as people do. And it's not a fact that the market's opinion is the only correct one. The Fed thinks differently. Yes, the central bank plans to lower rates, but what kind of downturn are we talking about when GDP shoots up 2.8% in the second quarter, and business activity in the services sector quickly recovers after the worst performance in four years?

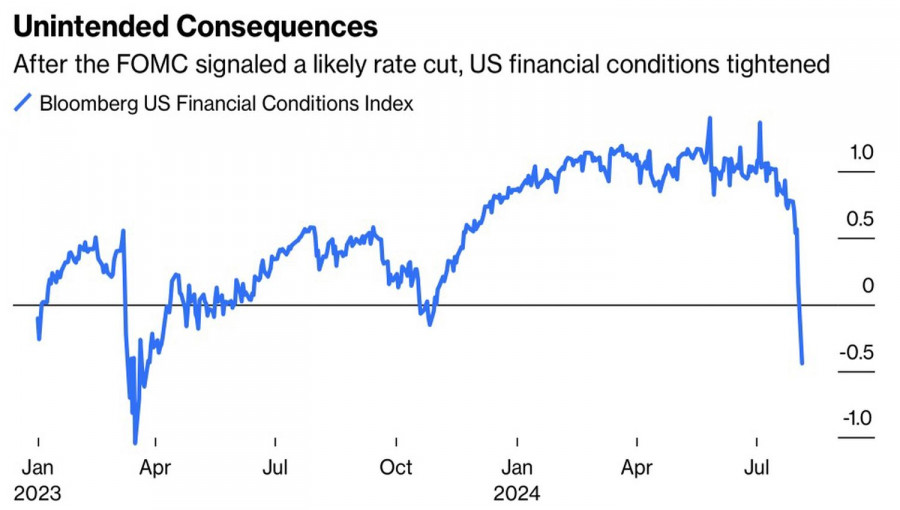

The yen and the Fed became the primary beneficiaries of market panic. For a long time, the central bank did not lower rates, worrying that easing financial conditions might help high inflation return. However, massive stock sell-offs have dropped financial conditions. Now, it can be assumed that prices, at worst, have anchored and, at best, continue to fall towards the 2% target. It's time to ease monetary policy.

The dynamics of financial conditions in the US

It is highly doubtful that Fed Chair Jerome Powell and his team will act as quickly as the markets expect. They anticipate a sharp cut in borrowing costs by 50 bps in September and November, followed by a switch to 25 bps in December. Does that sound familiar? Derivatives made similar forecasts for aggressive rate cuts in December 2023 after the Fed's dovish pivot. How did that end? With pleasant surprises from the US economy and a dollar rising from the ashes. Is history repeating itself?

Why not? Suppose the slowdown in employment is due to the impact of hurricanes, and unemployment is rising due to the layoff of temporary workers. Why shouldn't the labor market deliver a pleasant surprise in early September?

Panic eventually ends. Investors have moments of clarity, and the situation is such that you cannot build the correct narrative on just one report. The Fed will only aggressively lower rates in the event of a recession, which is nowhere to be seen. Market expectations for the scale of monetary easing are overblown, and if so, the US dollar will soon regain control over Forex.

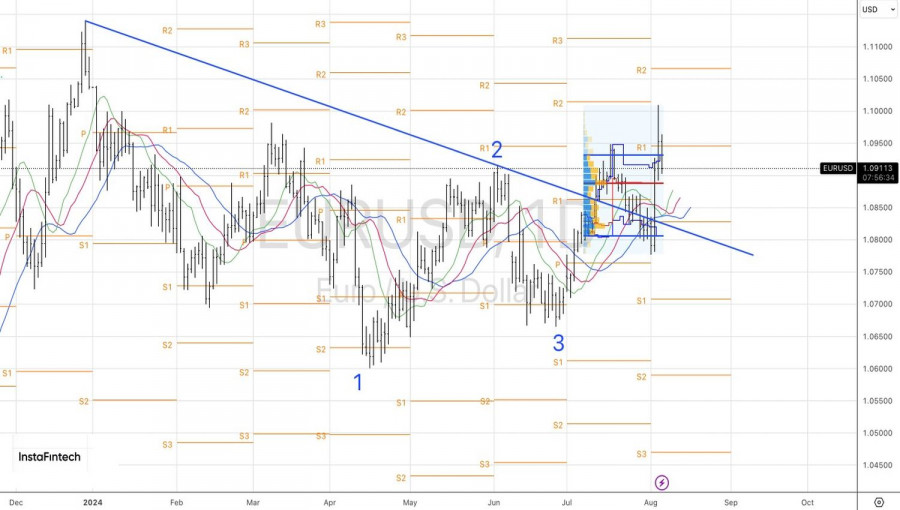

Technically, on the daily chart, EUR/USD is retracing to the upward trend. If the bears cling to the upper boundary of the fair value range at 1.0805-1.0930 and keep the pair within it, the risk of falling to 1.089 and 1.0855 increases. As long as the euro trades below $1.093, it is preferable to favor selling.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment