EUR/USD: trading tips for beginners for the European session on July 31

Forecast

Back

Forecast

EUR/USD: trading tips for beginners for the European session on July 31

Overview of trading and tips on

The premium article will be available in

00:00:00

31.07.2024 10:03 AM

The premium article will be available in00:00:00

31.07.2024 10:03 AM

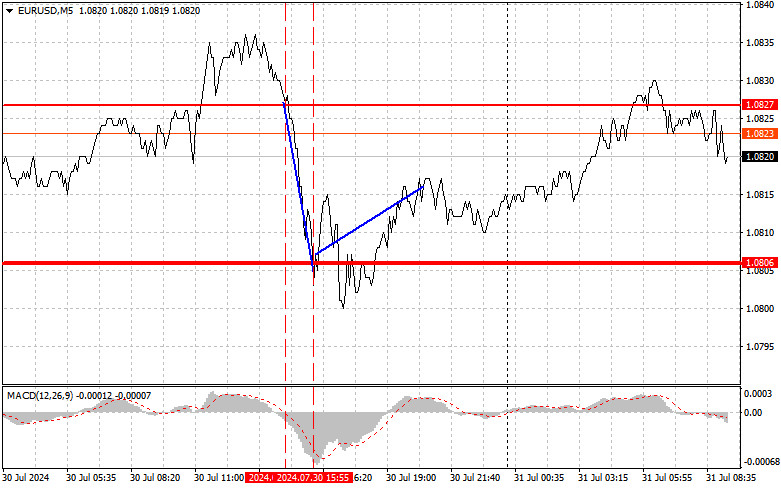

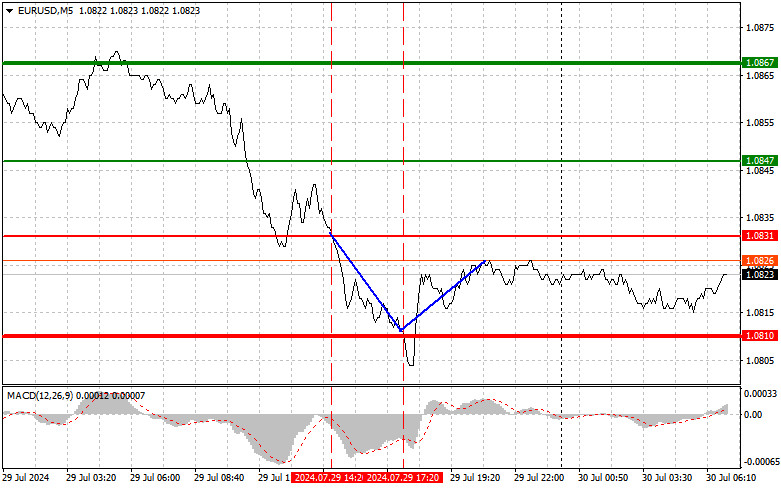

Overview of trading and tips on EUR/USDThe price test of 1.0827 occurred when the MACD indicator started to move down from the zero mark, confirming the correct entry point for selling the euro following the intraday trend. As a result, EUR/USD dropped 20 pips. Buying on the rebound at 1.0806 also yielded about 15 pips of profit. Strong US data led to a fall in the euro in the second half of the day. However, after testing the weekly low,

Fresh articles are available only to premium users

Read analytics in early access, getting information first

Get

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday July 31, 2024.

Technical analysis

Back

Technical analysis

Technical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday July 31, 2024.

If we look at the 4-hour

The premium article will be available in

00:00:00

31.07.2024 06:28 AM

The premium article will be available in00:00:00

31.07.2024 06:28 AM

If we look at the 4-hour chart of the AUD/JPY cross currency pair, it appears that there is a deviation between its price movement and the MACD Histogram indicator, coupled with the condition of the EMA 20 which is below the EMA 50 and the price movement of the currency pair which is below both EMAs, then in the near future AUD/JPY has the potential to continue its weakening to the level of 98.96 if this level is successfully broken

Fresh articles are available only to premium users

Read analytics in early access, getting information first

Get

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

EUR/USD. Out of time: the pair ignored important economic reports

During the European trading session, the EUR/USD pair tried to develop corrective growth amid mixed data on Germany's and the Eurozone's GDP. However, the price turned down again at the start of the U.S. session. Traders are clearly nervous ahead of the Federal Reserve's July meeting, the results of which will be announced on Wednesday, July 31. While it cannot be said that market participants completely ignored the European reports, traders are currently anticipating the Fed's verdict.

There is no doubt that the latest reports will resurface in the future when the discussion about the prospects of the European Central Bank's rate cuts in September and subsequent meetings resumes. But at the moment, these reports are useless for EUR/USD, partly due to their contradictory nature.

Germany's GDP unexpectedly decreased by 0.1% quarter-on-quarter in the second quarter, while most experts expected a 0.1% increase. The German economy grew by 0.2% in the first quarter, while it contracted by 0.5% in the fourth quarter of 2023. On a year-on-year basis, GDP volume increased by 0.3% (in line with the forecast) after a decline of 0.8% in the previous quarter.

In other words, Europe's largest economy showed weak results. However, the Eurozone GDP report was on the other side of the scale. Here, the main components met the forecast or were in the "green." The European economy grew by 0.3% quarter-on-quarter in the second quarter, as in the first quarter. The forecast was at 0.2%. On a year-on-year basis, GDP volume increased by 0.6% (marking the third consecutive quarter of growth).

The Consumer Price Index for Germany was also published on Tuesday. The report supported the euro, especially since it was released ahead of the Eurozone inflation report. The German CPI rose by 0.3% month-on-month in July (in line with the forecast) and 2.3% year-on-year (against a forecast of 2.2%). The harmonized index, the preferred inflation indicator of the European Central Bank, increased by 2.6% year-on-year, while most experts had predicted a more modest growth of 2.4% (June saw a 2.5% increase).

What do we have in summary? Fact #1: The Eurozone economy is growing despite the downturn in the German economy. Fact #2: Inflation in Germany has slightly accelerated, indicating a "green tint" in the inflation report for the entire Eurozone (this report will be released on Wednesday, July 31).

In my opinion, these facts reduce the likelihood of the ECB easing monetary policy in September, especially if the Eurozone inflation rate does accelerate. The suspense surrounding the outcome of the September meeting has intensified — a September rate cut no longer seems like a foregone conclusion.

It is important to recall that the ECB's July meeting results were unfavorable for the single currency precisely because the central bank indicated it was still uncertain about a rate cut in September. One phrase from ECB President Christine Lagarde ("Any decision can be made in September") speaks volumes. In answer to this question, the ECB head noted that the issue of a rate cut in September remains open, but the decision will depend on incoming data. Commenting on the Eurozone's CPI report for June (which reflected a slight slowdown in the overall CPI and stagnation in the core index), she stated that the services sector, where inflation is 4.1%, has increased upward risks.

If the Eurozone inflation report for July disappoints the ECB again, the prospects for easing monetary policy in September will be in serious doubt. According to preliminary forecasts, CPI is expected to slow down in July: the overall CPI (down to 2.4% from the previous 2.5%) and the core index (down to 2.8% from the previous 2.9%) are projected to show a downward trend. However, the puzzle will come together if inflation indicators accelerate (contrary to forecasts). The market will again discuss the ECB not lowering rates in early autumn. In that case, the euro could receive substantial support.

However, regardless of its outcome, do not expect the EUR/USD pair to react immediately to the Eurozone inflation report. Until the Fed's verdict is announced, dollar pairs will be focused solely on the behavior of the US currency, and the EUR/USD pair will be no exception.

However, once the excitement over the Fed's July meeting results subsides, traders will recall the European data. If the Fed does not favor the greenback, the rise in inflation in Germany and (possibly) in the Eurozone could play an important, decisive role in determining the pair's upward trend. However, it's still too early to talk about this. All attention is on the Fed, which will determine the dollar's fate in the medium term.

The material has been provided by InstaForex Company - www.instaforex.com #EUR/USD. Out of time: the pair ignored important economic reports

There is no doubt that the latest reports will resurface in the future when the discussion about the prospects of the European Central Bank's rate cuts in September and subsequent meetings resumes. But at the moment, these reports are useless for EUR/USD, partly due to their contradictory nature.

Germany's GDP unexpectedly decreased by 0.1% quarter-on-quarter in the second quarter, while most experts expected a 0.1% increase. The German economy grew by 0.2% in the first quarter, while it contracted by 0.5% in the fourth quarter of 2023. On a year-on-year basis, GDP volume increased by 0.3% (in line with the forecast) after a decline of 0.8% in the previous quarter.

In other words, Europe's largest economy showed weak results. However, the Eurozone GDP report was on the other side of the scale. Here, the main components met the forecast or were in the "green." The European economy grew by 0.3% quarter-on-quarter in the second quarter, as in the first quarter. The forecast was at 0.2%. On a year-on-year basis, GDP volume increased by 0.6% (marking the third consecutive quarter of growth).

The Consumer Price Index for Germany was also published on Tuesday. The report supported the euro, especially since it was released ahead of the Eurozone inflation report. The German CPI rose by 0.3% month-on-month in July (in line with the forecast) and 2.3% year-on-year (against a forecast of 2.2%). The harmonized index, the preferred inflation indicator of the European Central Bank, increased by 2.6% year-on-year, while most experts had predicted a more modest growth of 2.4% (June saw a 2.5% increase).

What do we have in summary? Fact #1: The Eurozone economy is growing despite the downturn in the German economy. Fact #2: Inflation in Germany has slightly accelerated, indicating a "green tint" in the inflation report for the entire Eurozone (this report will be released on Wednesday, July 31).

In my opinion, these facts reduce the likelihood of the ECB easing monetary policy in September, especially if the Eurozone inflation rate does accelerate. The suspense surrounding the outcome of the September meeting has intensified — a September rate cut no longer seems like a foregone conclusion.

It is important to recall that the ECB's July meeting results were unfavorable for the single currency precisely because the central bank indicated it was still uncertain about a rate cut in September. One phrase from ECB President Christine Lagarde ("Any decision can be made in September") speaks volumes. In answer to this question, the ECB head noted that the issue of a rate cut in September remains open, but the decision will depend on incoming data. Commenting on the Eurozone's CPI report for June (which reflected a slight slowdown in the overall CPI and stagnation in the core index), she stated that the services sector, where inflation is 4.1%, has increased upward risks.

If the Eurozone inflation report for July disappoints the ECB again, the prospects for easing monetary policy in September will be in serious doubt. According to preliminary forecasts, CPI is expected to slow down in July: the overall CPI (down to 2.4% from the previous 2.5%) and the core index (down to 2.8% from the previous 2.9%) are projected to show a downward trend. However, the puzzle will come together if inflation indicators accelerate (contrary to forecasts). The market will again discuss the ECB not lowering rates in early autumn. In that case, the euro could receive substantial support.

However, regardless of its outcome, do not expect the EUR/USD pair to react immediately to the Eurozone inflation report. Until the Fed's verdict is announced, dollar pairs will be focused solely on the behavior of the US currency, and the EUR/USD pair will be no exception.

However, once the excitement over the Fed's July meeting results subsides, traders will recall the European data. If the Fed does not favor the greenback, the rise in inflation in Germany and (possibly) in the Eurozone could play an important, decisive role in determining the pair's upward trend. However, it's still too early to talk about this. All attention is on the Fed, which will determine the dollar's fate in the medium term.Pentru mai multe detalii, va invitam sa vizitati stirea originala.

EUR/USD: trading tips for beginners for the European session on July 30

Forecast

Back

Forecast

EUR/USD: trading tips for beginners for the European session on July 30

Overview of trading and tips on

The premium article will be available in

00:00:00

30.07.2024 09:34 AM

The premium article will be available in00:00:00

30.07.2024 09:34 AM

Overview of trading and tips on EUR/USDThe price test of 1.0831 occurred when the MACD indicator started to move down from the zero mark, confirming the correct entry point for selling the euro according to the intraday trend. As a result, EUR/USD dropped 20 pips. Buying on the rebound at 1.0810 also brought around 15 pips of profit. The absence of US data helped the euro stall by the end of the day; however, sellers of risky assets have the

Fresh articles are available only to premium users

Read analytics in early access, getting information first

Get

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Forecast for EUR/USD on July 30, 2024

EUR/USD

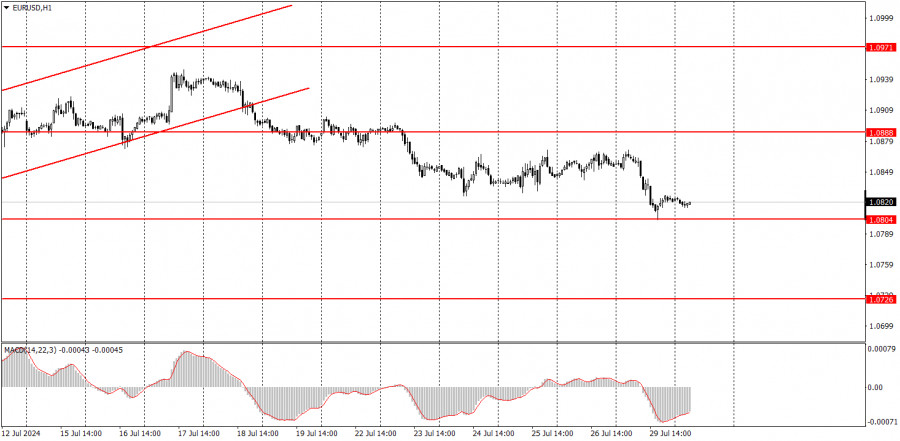

Yesterday, the euro lost 33 pips. The day's low hit the support of the balance line on the daily chart, and the Marlin oscillator entered downtrend territory.

Preparation is underway to break through the support at 1.0788 and the MACD line, which is slightly below the current price level. Consolidating below this level will open the first target at 1.0724. The price could further fall into the range of 1.0636/50.

On the 4-hour chart, the price turned downward from the balance indicator line. The Marlin oscillator has settled on a downward trajectory, and after a respite, it will be ready to fall further.

The material has been provided by InstaForex Company - www.instaforex.com #Trading plan for EUR/USD on July 30. Simple tips for beginners

Trading plan

Back

Trading plan

Trading plan for EUR/USD on July 30. Simple tips for beginners

Analyzing Monday's trades:EUR/USD on 1H chart

The premium article will be available in

00:00:00

30.07.2024 06:36 AM

The premium article will be available in00:00:00

30.07.2024 06:36 AM

Analyzing Monday's trades:EUR/USD on 1H chart EUR/USD delighted traders with its decent movement on Monday. It is worth mentioning that while the movement wasn't consequential, it was trend-based and more volatile than expected. There were no fundamental or macroeconomic events on Monday, neither in the US nor the EU, yet the market still found reasons to buy the dollar. This is very positive, as it aligns with our expectations. Let's recall that the pair is trading globally

Fresh articles are available only to premium users

Read analytics in early access, getting information first

Get

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Forecast for EUR/USD on July 30, 2024

Yesterday, the euro lost 33 pips. The day's low hit the support of the balance line on the daily chart, and the Marlin oscillator entered downtrend territory.

Preparation is underway to break through the support at 1.0788 and the MACD line, which is slightly below the current price level. Consolidating below this level will open the first target at 1.0724. The price could further fall into the range of 1.0636/50.

On the 4-hour chart, the price turned downward from the balance indicator line. The Marlin oscillator has settled on a downward trajectory, and after a respite, it will be ready to fall further.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Forecast for GBP/USD on July 30, 2024

Yesterday, the pound rushed in both directions with a total range of 80 pips, but this did not lead to any significant outcome, as the pair closed the day down by seven pips. The balance line on the daily time frame limited the pair's decline.

The Marlin oscillator has started falling from the neutral zero line. This morning, the price is also trying to break through the support level of 1.2847. The nearest target is 1.2755, with the MACD line approaching it more closely. Breaking through this level and the MACD line will signify further medium-term decline.

The balance line also limited the pair's rise on the 4-hour chart. The Marlin oscillator is on the zero line, ready to move down. It is likely waiting for an initial signal from the price—breaking through the support at 1.2847.

Pentru mai multe detalii, va invitam sa vizitati stirea originala.

Forecast for AUD/USD on July 30, 2024

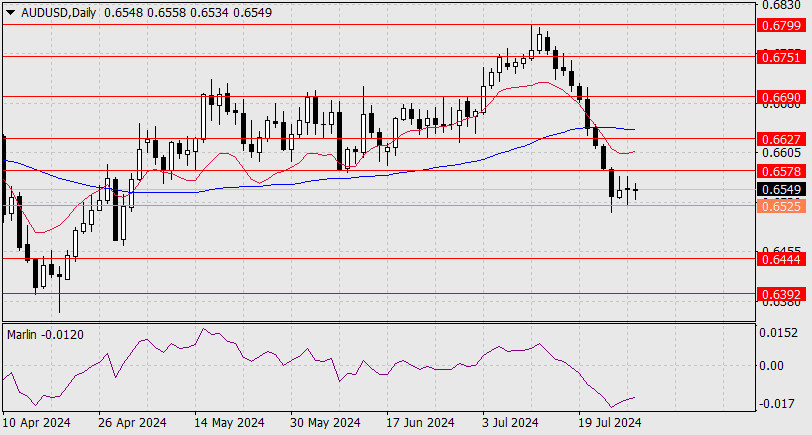

AUD/USD

The Australian dollar spent the entire Monday in a neutral range of 0.6525/78. Today might also be spent anticipating the Federal Reserve meeting, but the price shows a downward trend this morning.

A break below the July 25 low of 0.6517 will signal the price's intention to reach the target level of 0.6444, the February 13 low. The Marlin oscillator on the daily chart is currently following the price and is not showing any leading signals. On the 4-hour chart, Marlin has slightly moved above the border of the bullish territory.

If the price falls below the intermediate level of 0.6525, Marlin could fall ahead of the price, pulling it down and preventing it from forming a new consolidation, except at the level of 0.6444. A downward trend is based on the combined signs from both time frames.

The material has been provided by InstaForex Company - www.instaforex.com #