The euro continues to rise despite the wave patterns and the news background. In my opinion, the market is not paying enough attention to the news, which is why the EUR/USD pair is trading in an odd manner. Clearly, this cannot last for long, and the market cannot constantly ignore incoming information. I believe that market participants have already come to terms with the fact that the European Central Bank will lower the rate in June and then reduce it at least twice more during the year. Meanwhile, it is difficult to expect even two rounds of rate cuts from the Federal Reserve. I assume that the market understands how futile this is, and that is precisely why they are buying the euro. The logic is simple—drive the euro as high as possible now to sell it later at a favorable rate. This is just a hypothesis, but it has a right to exist.

There are few events that could potentially affect market sentiment. Firstly, I would highlight the inflation reports for May in Germany and the Eurozone. I believe these reports could trigger a strong market reaction, as inflation in both cases might accelerate slightly. In Germany, it could rise from 2.2% to 2.4%, and in the Eurozone from 2.4% to 2.5% year-on-year. I believe that such an increase will not be an obstacle for the ECB. Interest rates may still be reduced following the June meeting. But how will the market "understand" these reports? If inflation rises, market participants may believe that the ECB will postpone the first round of monetary policy easing to the next meeting to ensure its downward trajectory. And it doesn't matter if this is actually the case. The market is eager to buy the euro, so any report that theoretically supports the bulls' outlook could push the euro higher.

Among other reports from the Eurozone, I can only highlight the unemployment rate and retail sales in Germany. However, these reports are unlikely to affect market sentiment. We need the instrument to fall, so that means that the bulls must not be able to break through the 1.0880 mark.

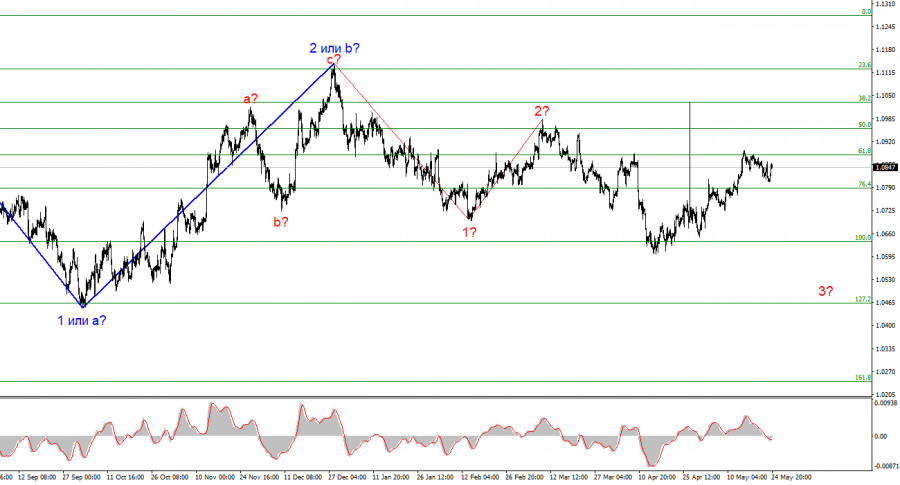

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. In the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I anticipate a favorable moment for new short positions with targets around the 1.0462 mark. An unsuccessful attempt to break through the 1.0880 mark, which corresponds to 61.8% by Fibonacci, may indicate that the market is ready to sell, but it may not be the only one.

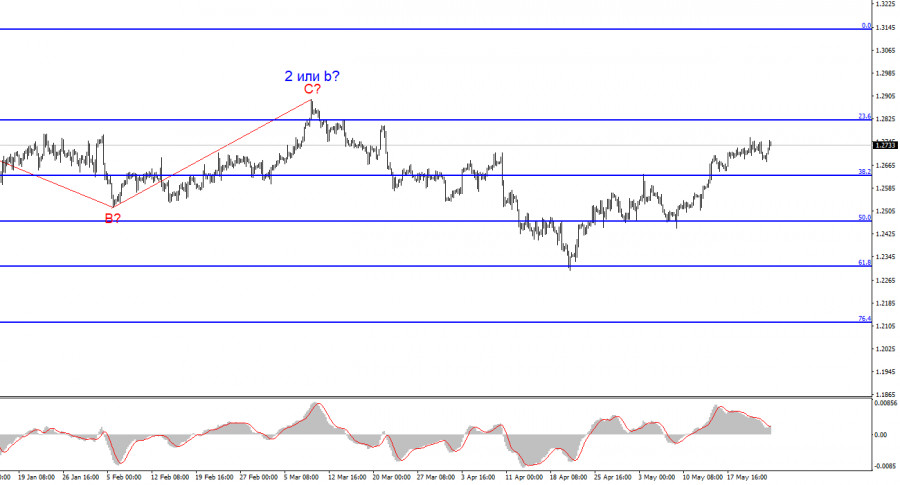

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has not yet been canceled. A successful attempt to break 1.2625, which corresponds to 38.2% Fibonacci by Fibonacci from above, will indicate the possible end of an internal, corrective wave 3 or c, which looks like a classic three-wave pattern.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

The material has been provided by InstaForex Company - www.instaforex.com #

Download NOW!

Download NOW!

No comments:

Post a Comment